Investment Cycle

Successful investors know to consistently and repeatedly research, analyze and learn to achieve the results they want. But these take practice as well as time. With investors like you in mind, Jitta develops all sorts of investing technology to help make your investment cycle simpler, faster and more convenient.

RESEARCH

1.Discover stocks withJitta Ranking

- “Wonderful companies at a fair price” ranked by investment potential

- Explore stocks by country (U.S., U.K., Japan, Singapore, Thailand, Vietnam and Hong Kong)

- Explore byinvesting preferences, like dividend, growth and turnaround stocks

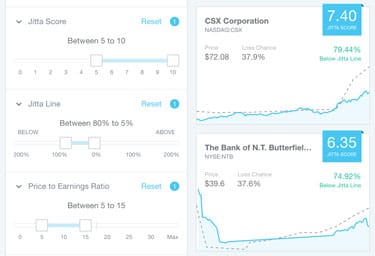

2.Find stocks by qualities onJitta Playlist

- Create or choose your own successful investment strategies

- Invest in criteria-meeting stocks every year

ANALYZE

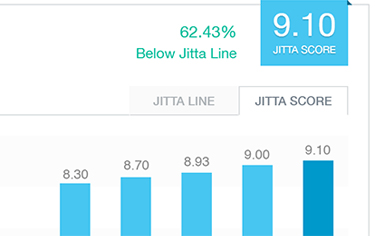

3.Check historical Jitta Score

- Jitta Score of 7 or more means good business

- Stellar companies have consistently high Jitta Score

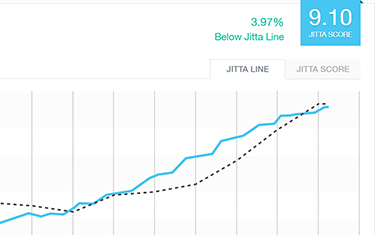

4.Make sure Jitta Line is on the way up

- Company can raise its business value every year

- The lower the price hits below Jitta Line the lesser the risk

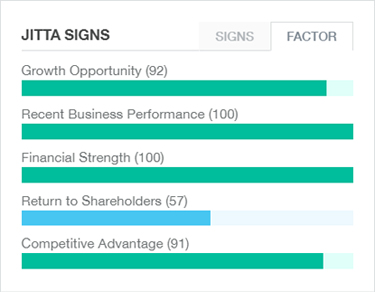

5.Zero in on stocks with positive Jitta Factors

- Five important facets of business quality

- Each facet should receive at least 50 points

- Points should total more than 350

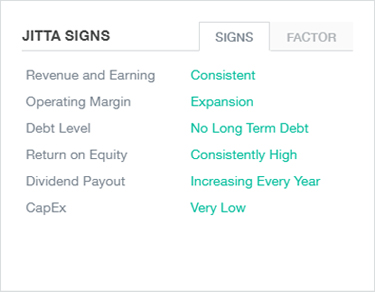

6.Pick companies with green Jitta Signs

- The more green signals, the stronger the company

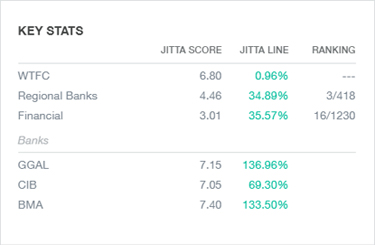

7.Examine Key Stats

- Compare Jitta Score/Jitta Line with competitors

- Compare Jitta Score/Jitta Line with industry average

- Wonderful companies have higher Jitta Score than competitors and industry average

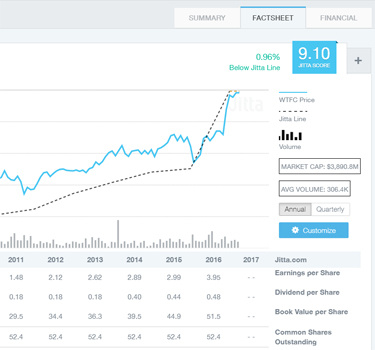

8.Analyze financials with Jitta FactSheet

- Past 10 years/10 quarters of financial statements

- Compare up to three companies

- Customize numbers and format as desire

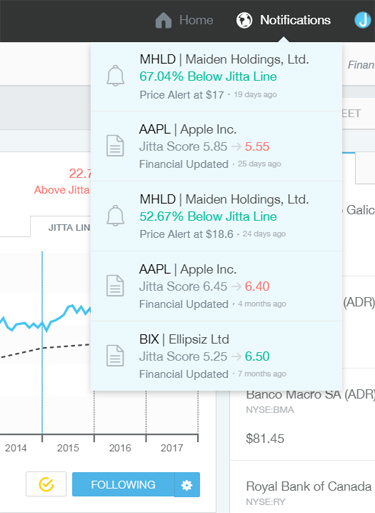

9.Follow stocks with potential

- Keep a close watch on business performance

- Get Jitta Score and Jitta Line updates every quarter

- Get alerted when the price is right

10.Invest in at least 5 companies

- Choose wonderful companies at a fair price OR Choose Top 5, 10, 20, 30 stocks on Jitta Ranking

- Each stock makes up less than 20% of portfolio

- Choose companies from various industries

- Don’t invest in more than two companies from the same industry

LEARN

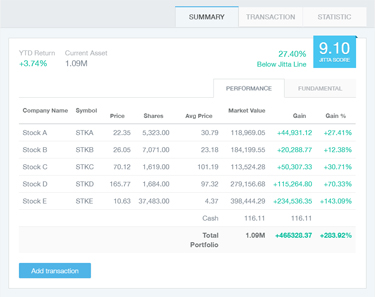

11.Record investment inJitta Portfolio

- Compare performance with market index

- Identify strengths/weaknesses of portfolio

- Rebalance portfolio every 12 months