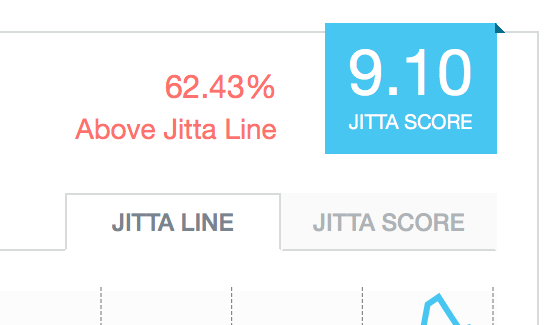

1 - Look for Jitta Score > 7

The higher the Jitta Score, the better the company

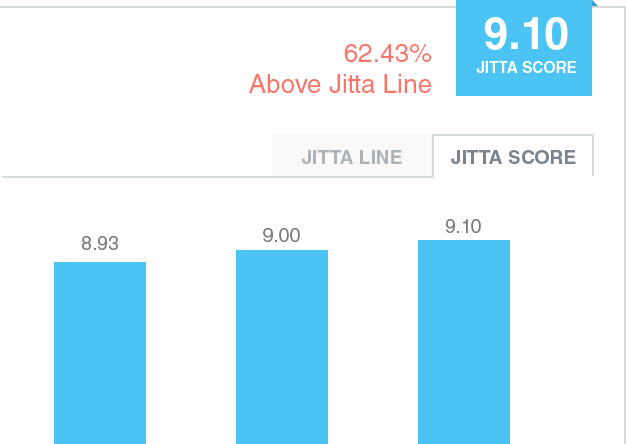

2 - Look at Historical Jitta Score

- Great companies should have

- Jitta Scores > 5 every year (even in a bad economy)

- Consistent and stable Jitta Scores

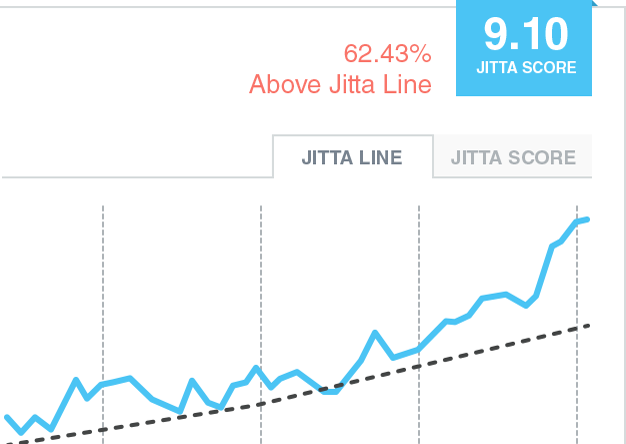

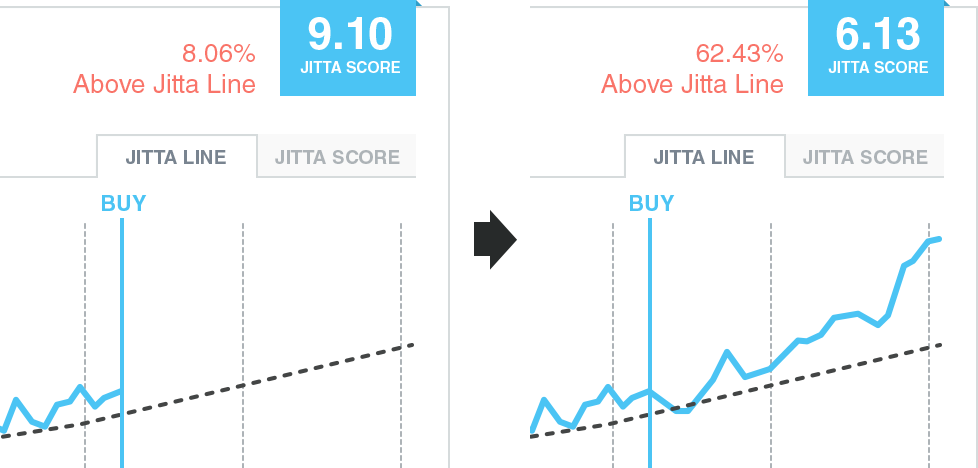

3 - Look for Jitta Line uptrend

- Companies can increase market share and business value every year

- The further the price is below the Jitta Line, the more margin of safety to invest

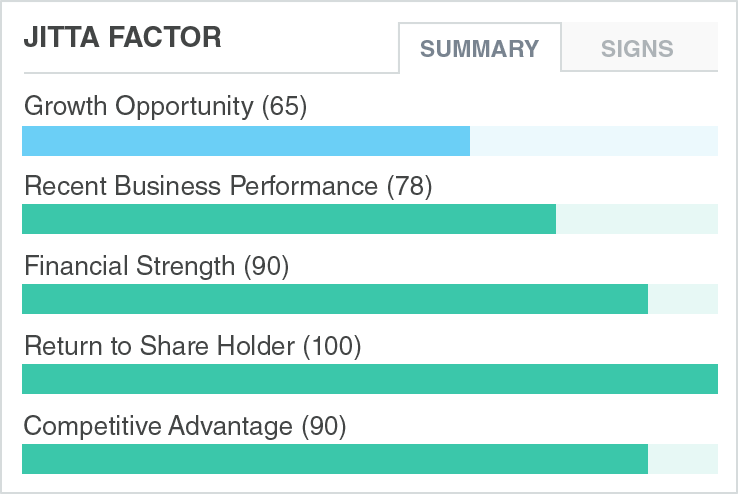

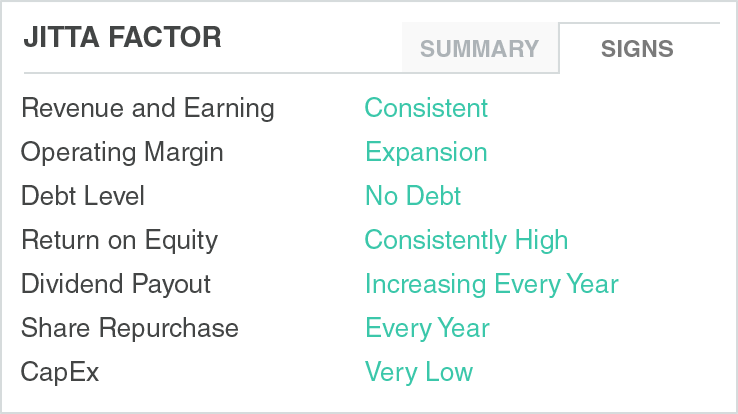

4 - Look for Good Jitta Factors

- Scores in Jitta Factors indicate strength of the companies in 5 important aspects

- A good company should have score > 50 in every factor and have a total score > 350

5 - Look for Green light in Jitta Signs

- The more good signs (green), the better

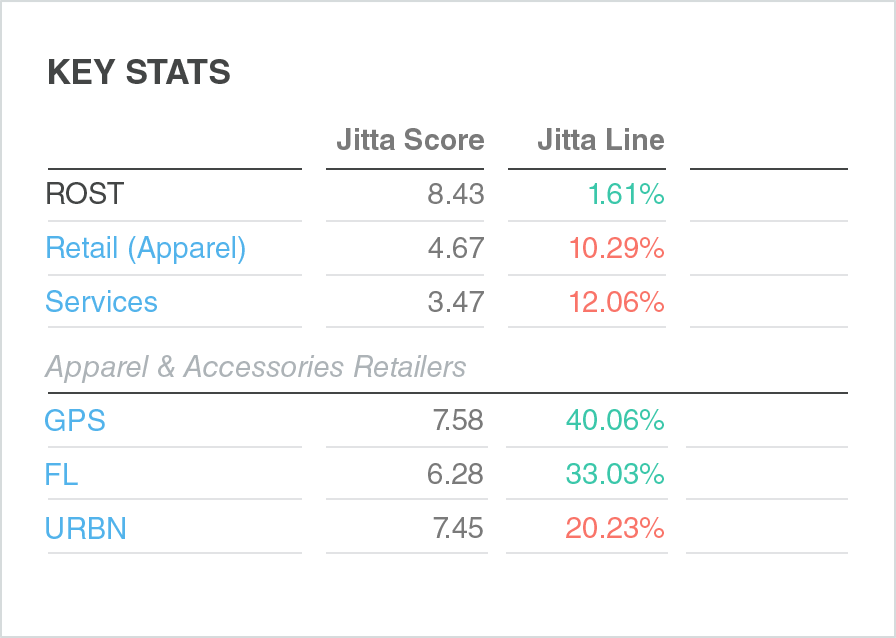

6 - Look at Key Stats

- Compare Jitta Score, Jitta Line with industry and sector average

- A great company should have higher Jitta Score compared with its peers

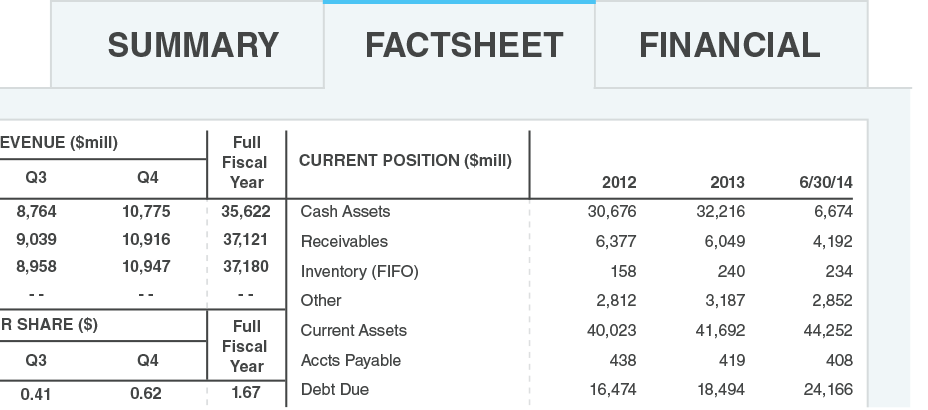

7 - Look at

Factsheet

- Analyze all important financial data by yourself

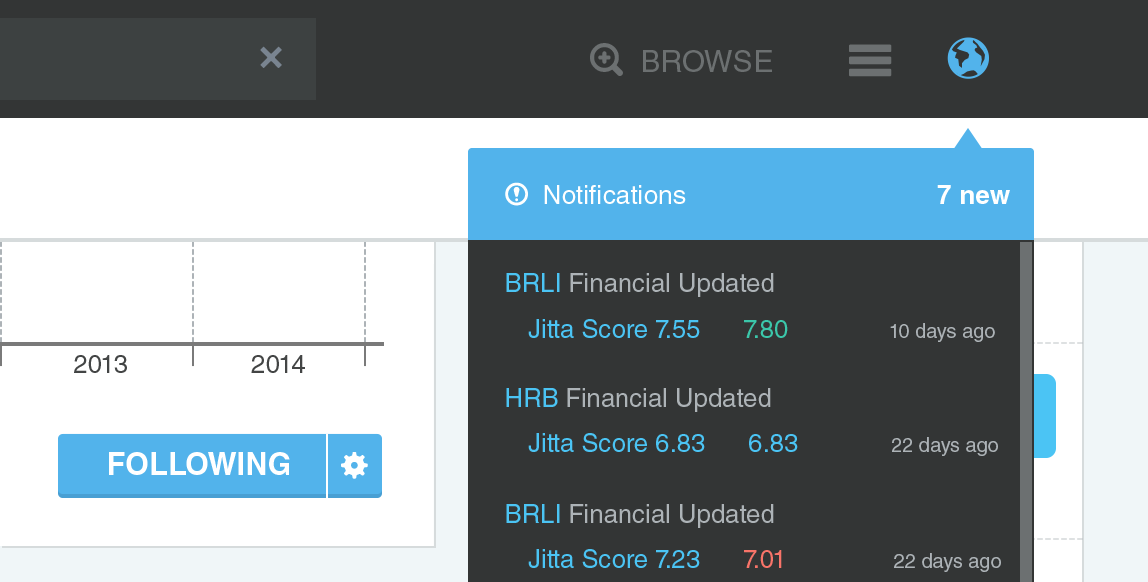

8 - Follow Favorite stock to get update

- Jitta Score & Jitta Line will be updated every quarter when companies release new financial result

- Check notification and weekly email update

9 - Invest At Least 5 Stocks

- Jitta investment Concept

- "Buy a wonderful company at a fair price" (High Jitta Score at price on or below Jitta Line)

- Maximum 20% of total portfolio in each stock

- Maximum 2 stocks in the same industry

10 - Sell Stocks

- When Jitta Score & Jitta Line are decreasing (Company's business is in the down trend)

- When having better investment opportunities (Better company with lower price)