What investors should do at the beginning of each year is to evaluate their investment in the prior year, how well they performed, whether they met their target, and what mistakes they made so that they can learn and improve their investment in the next year.

At the beginning of this year, I woke up and started updating my returns from last year, and so I went back to study my past investment records, which had both good and bad investments… but there was one interesting thing I found, which I would like to share with you all in this article.

One of the hardest things about long-term investments is that it takes a very long time to discover if our investment decisions were right or wrong, and sometimes, these decisions might seem like the right ones (or wrong) in the short-run, but are actually the opposite of what the seem in the long-run.

Today, I would like to share with you two of my past mistakes (from the many mistakes I’d made). One was making me profits, the other a loss. One was making me happy, the other was making me sad. Ironically, the stock that was making profits is now making me sad today, and the stock that was making a loss turned out to be making me happy.

1. The stock that was making profits, yet making me sad.

Around the middle of 2010, I bought the stock, MNST (back then it was called HANS), which was an Energy Drinks company in the United States, which could rival the likes of Red Bulls.

When we look at the past financial figures, this was a winning company, and when we look at it quality-wise, the business is a very good one with a promising future for expansion.

I bought this stock in May at $17.63 and sold it in July at $24.7, making around a 40% profit.

When I sold it, I saw that the company’s profit that year had not grown so much and the stock price was about 30% higher than the fair price. So my decision to sell it seemed like quite a reasonably good one.

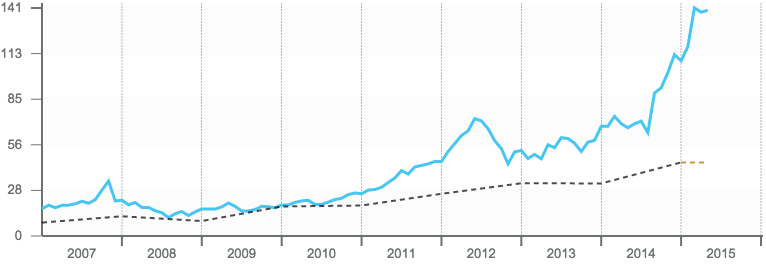

However, after that the business grew with its increasing price until this year, Coca Cola purchased 16.7% of MNST, driving up the price to $108.35. If only I had kept holding on to it until today, I would make a profit of around 500%.

Looking back, even though my investment of MNST generated a nice profit figure in the short-run, it was a mistake to let go of this good business so fast. And now all I can do is keep seeing MNST’s price rise higher and higher every year. Of course, even when MNST has now fallen to its fair price, it is still higher than the price I sold. So now I truly understand Buffet’s philosophy where if you get to invest in a good business with good management, the time period in which we should hold on to that stock is forever.

There are just a handful of great businesses. If we get the chance to own them, try not to let them go because in the long-run, holding onto these stocks will surely allow us to beat the market.

2. The stock that was making a loss, yet was making me happy.

At the beginning of 2011, I invested in a stock called ARO, a fashion clothing company selling to the middle-lower target, a brand that was a hit amongst teens in the US for some time. Its designs were quite similar to American Eagle and Abercrombie, but it was considerably cheaper.

http://www.jitta.com/stock/aro

Looking back at its past financial figures, this was a great company. It looked good from every angle, so I invested in ARO in January at $25.13.

However, after Q1’s performance was reported, everything seemed bad. They were unable to sell their products, making them give out a large discount, causing their operating margin (which used to be at 16%) to fall to around 5%; the first trimester’s profit fell from $0.48 to $0.2 (since ARO’s fiscal year is different from the calendar year, we have to look at year 2012 for 2011)

I decided to sell it in August when the price was at $13.4, two months after Q1’s figures were released, because I felt like I couldn’t predict whether ARO’s product would regain its popularity or not, and by using what strategy.

I made a huge loss of -46.67%. After I sold it, the price fell down to about $10 and slowly rose to $23. But at that point, I wasn’t fixating too much because when I was looking at the financial figures in the next trimester, they were still badly performing; and if you don’t know what’s making the stock price rise, the you just have to let it go.

Today, ARO’s price is at $2.32. It has a Jitta Score of 1.68 and a Jitta Line at zero. If I hadn’t sold ARO that day, today, the stock price would have fallen around 10 times, and I would make a loss of up to 90%.

So I did have some reconciliation in the fact that I sold it, and even if I made a loss back then, it was the right decision to sell. That loss also taught me an important lesson about fashion brands. For fashion brands targeted at the mass (middle-low), in which you do not have to purchase products regularly, if they are unable to follow the latest trends and produce new products quickly, there is a high risk in saturation. And by that time it would be too late to fix, because if the only key strength of the company is it’s cheap price, it would have to keep decreasing the price to attract buyers -it would be difficult to sustain this business in the long-run.

I hope that these two mistake cases have helped shape your perspective in investment; if we want to be long-term investors, we should view our investments in the long-run, and keep track of them in the long-run as well. It will help us picture the real reality of that stock.

Also, we shouldn’t get swayed by short-term losses and gains because in the end, nobody can predict the stock price in the short-run. Therefore, if we understand the big picture of investment and invest according to good principles, building long-term wealth is not going to be that difficult.