Jitta Portfolio (Beta)

No matter how many portfolios you own, track your overall returns easily on Jitta Portfolio (Beta). You can organize investments into multiple portfolios and currencies, while calculating investment performance and keeping an eye on asset allocation at the same time.

Click on your name at the top right corner of the screen and select PORTFOLIO.

If you’ve never created a portfolio on Jitta.com before, you’ll be greeted with this message. Just name your first portfolio and set its default currency. Then click CREATE PORTFOLIO.

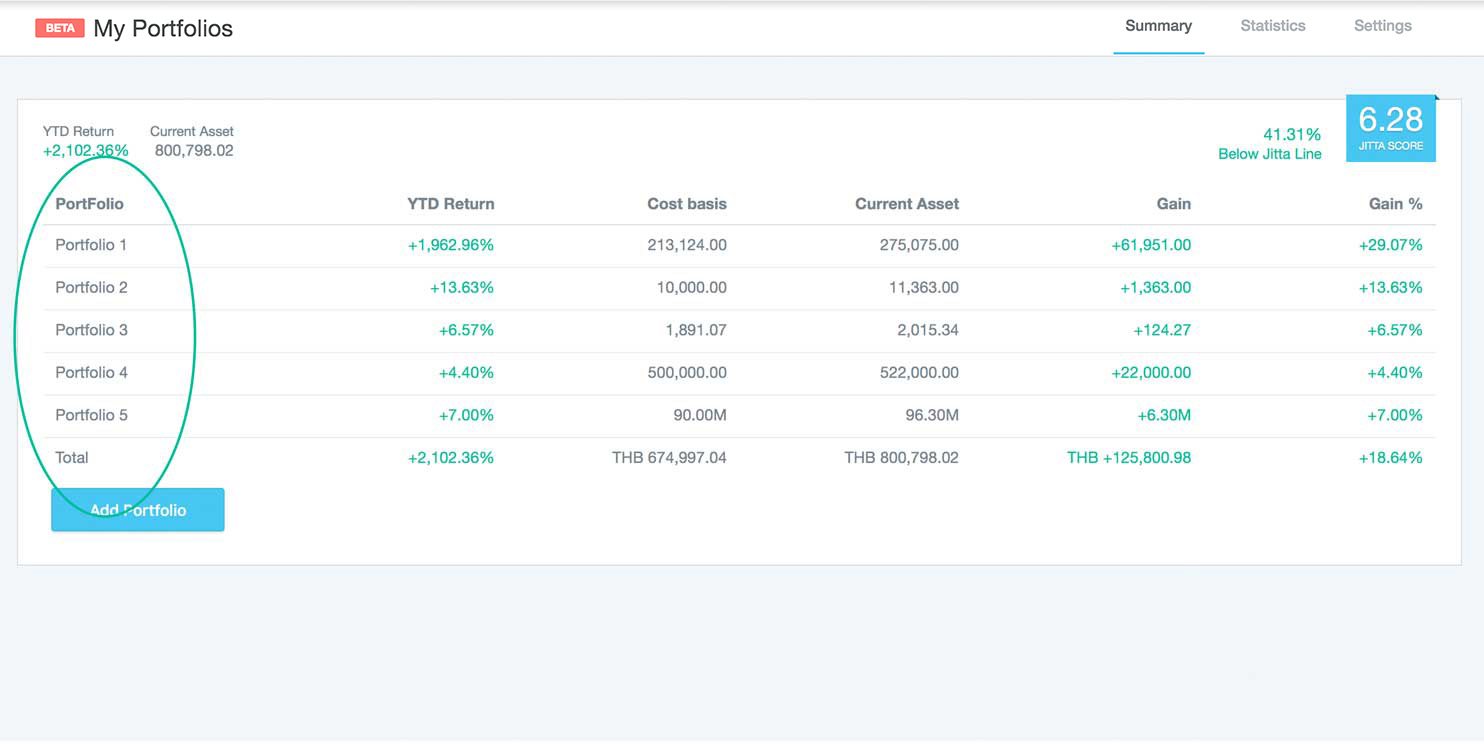

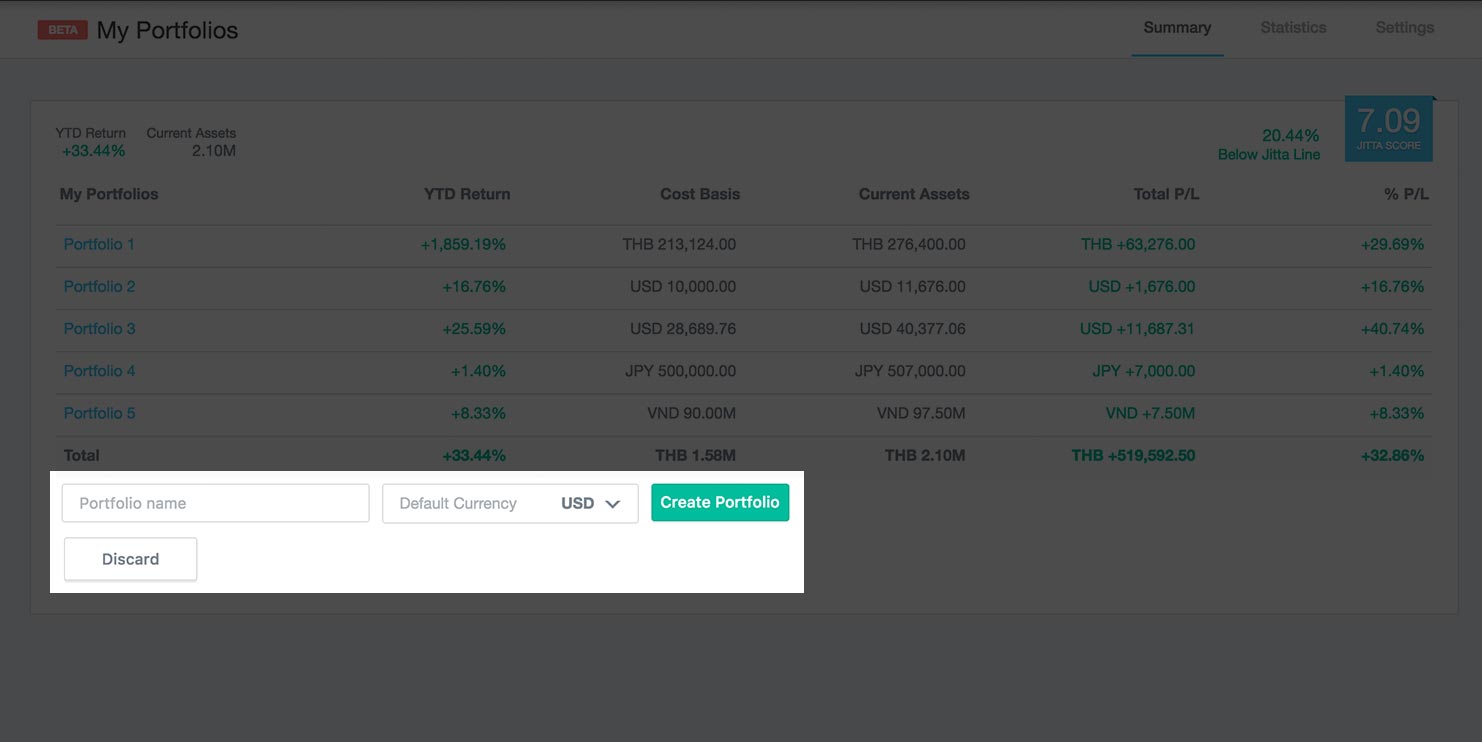

You can have as many portfolios as you want. All of them will show up on the front page of Jitta Portfolio (Beta) along with their performances, so you get the gist of how your investment is doing.

To add more portfolios, click ADD PORTFOLIO, fill out the name and currency, then click CREATE PORTFOLIO.

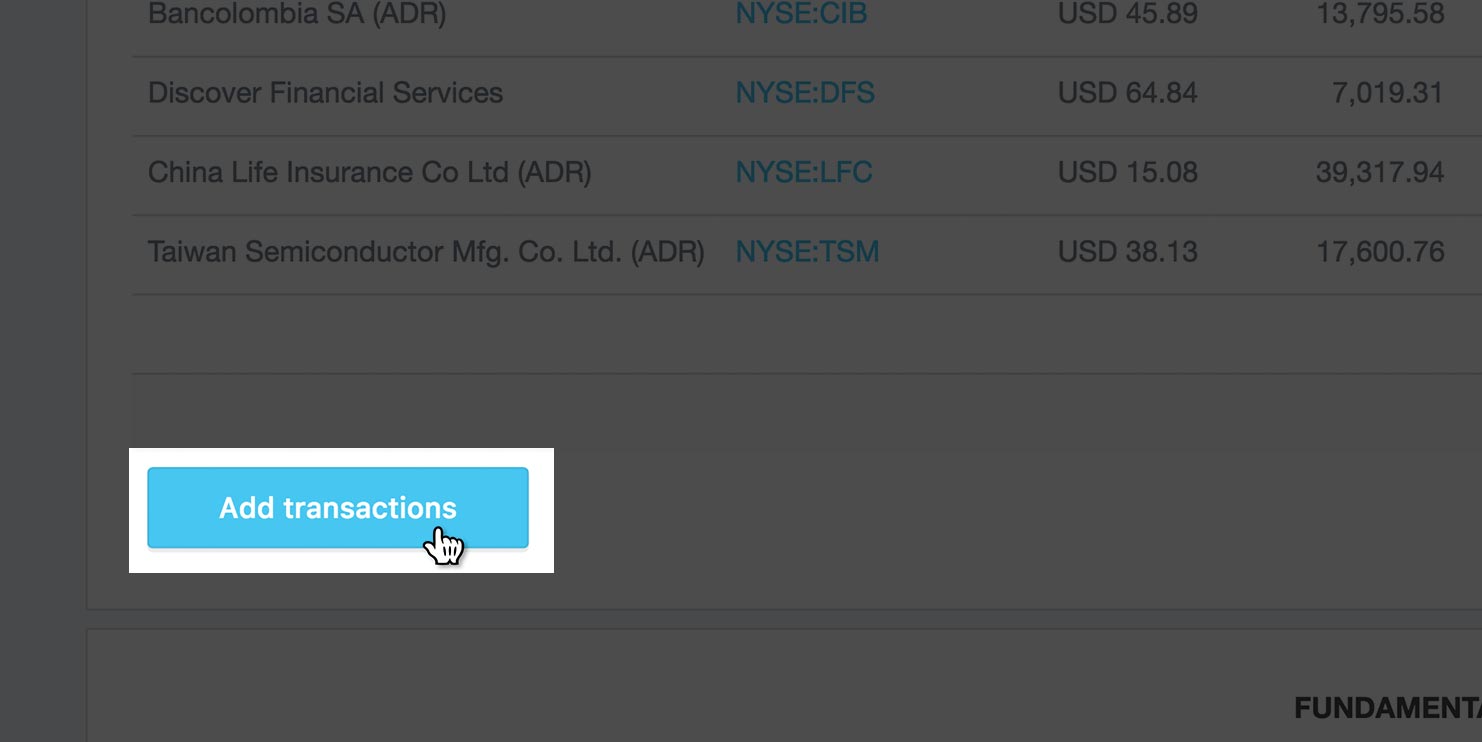

Begin tracking your investment by clicking ADD TRANSACTIONS to deposit money into your portfolio.

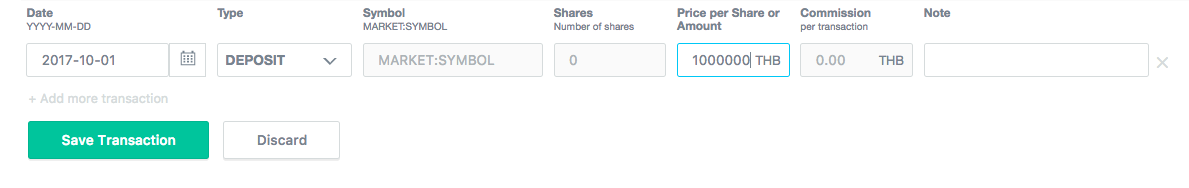

Fill out the date. Under TYPE, chose DEPOSIT, then put in the amount of cash you’re adding to the portfolio. This is similar to a trading account: you make a deposit before you can actually trade. Once all the information is filled out, click SAVE TRANSACTIONS.

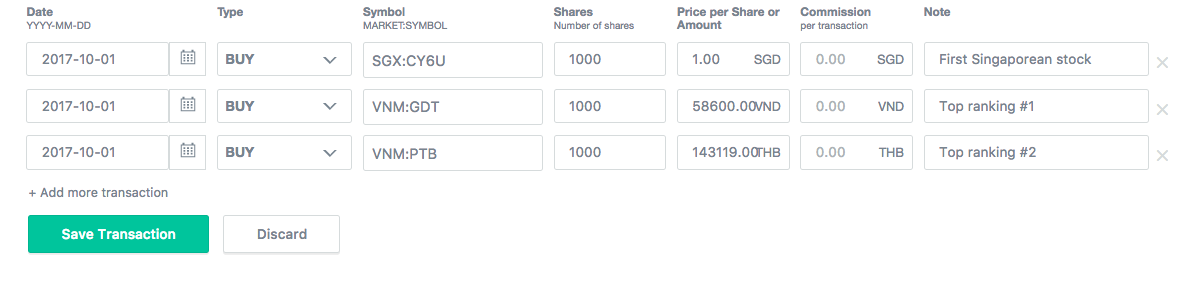

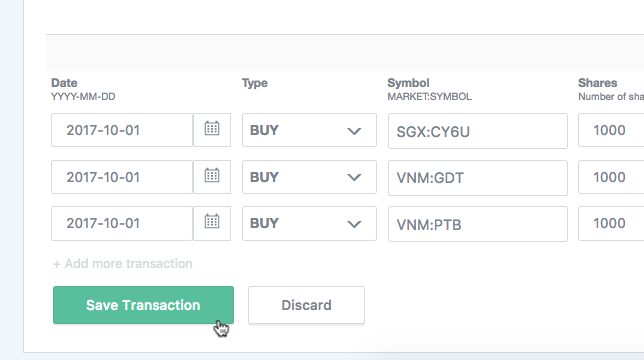

Now that you have cash, start adding other transactions, like buy, sell, and dividends, by clicking ADD TRANSACTIONS again and fill out the following information:

- Date of transaction

- Type of transaction, such as buy, sell, deposit, withdraw and dividend

- Stock Symbol has to follow this format MARKET:SYMBOL (e.g. NASDAQ:AAPL). Here are the abbreviations for other markets

- United States: NASDAQ, NYSE

- Thailand: BKK

- Singapore: SGX

- Japan: TKO

- Vietnam: VNM

- Hong Kong: HKG

- United Kingdom: LON

- Shares refer to the number of stocks you bought/sold (no comma needed)

- Price per share_Amount of money deposited_received as dividend (no comma needed)

- Commission

Note

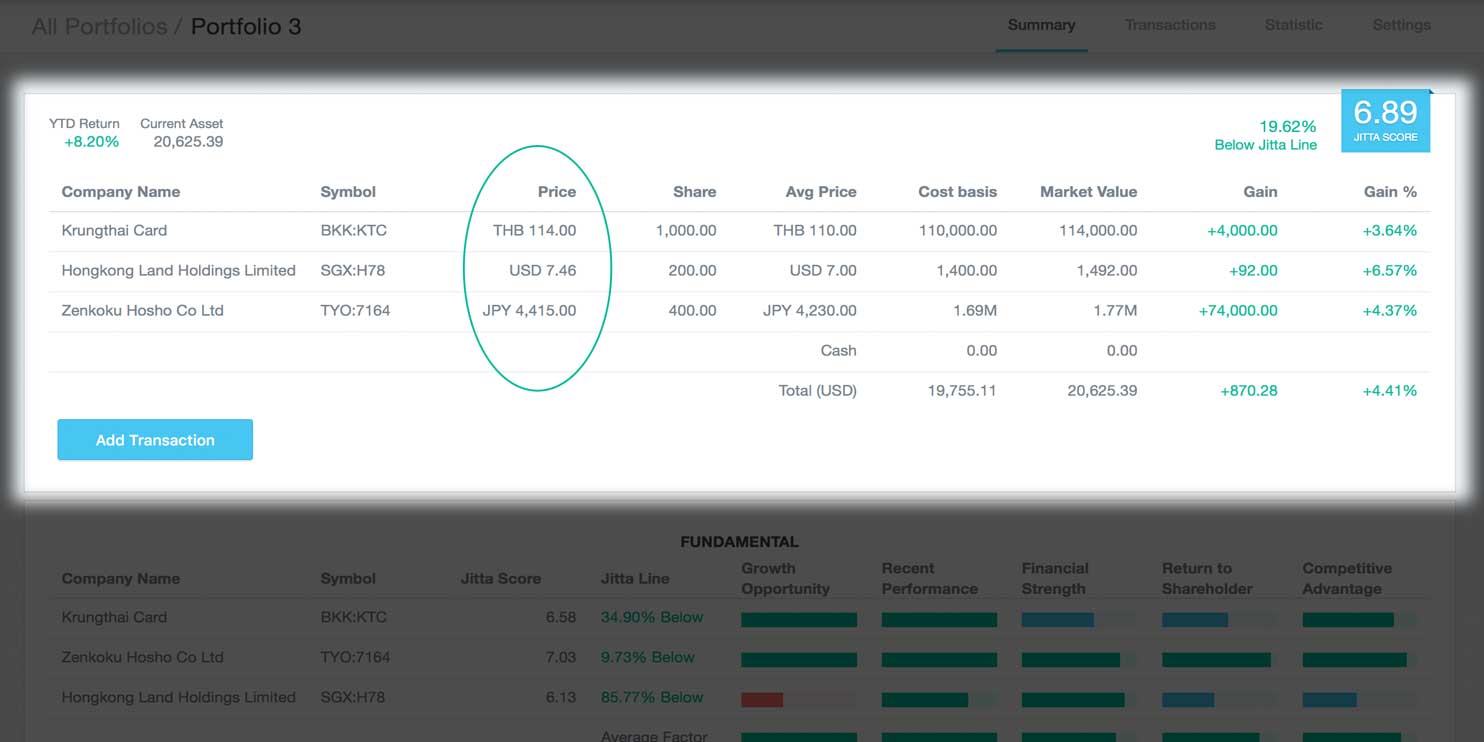

Add as many transactions as you want by clicking ADD ANOTHER TRANSACTION and filling out the information. You can choose a default currency for each portfolio and still record transactions in various currencies. For example, you create a portfolio tracking dividend stocks in various countries, but choose US dollar as the portfolio’s default currency. So when you record transactions, you fill in each stock’s local currency. But when you look at the overall market value of this portfolio, the number is shown in US dollar.

Notice that in the PRICE PER SHARE/AMOUNT column, you can use the actual currency used by a particular stock you’ve purchased. The system will automatically convert it to your default currency, based on today’s exchange rates.

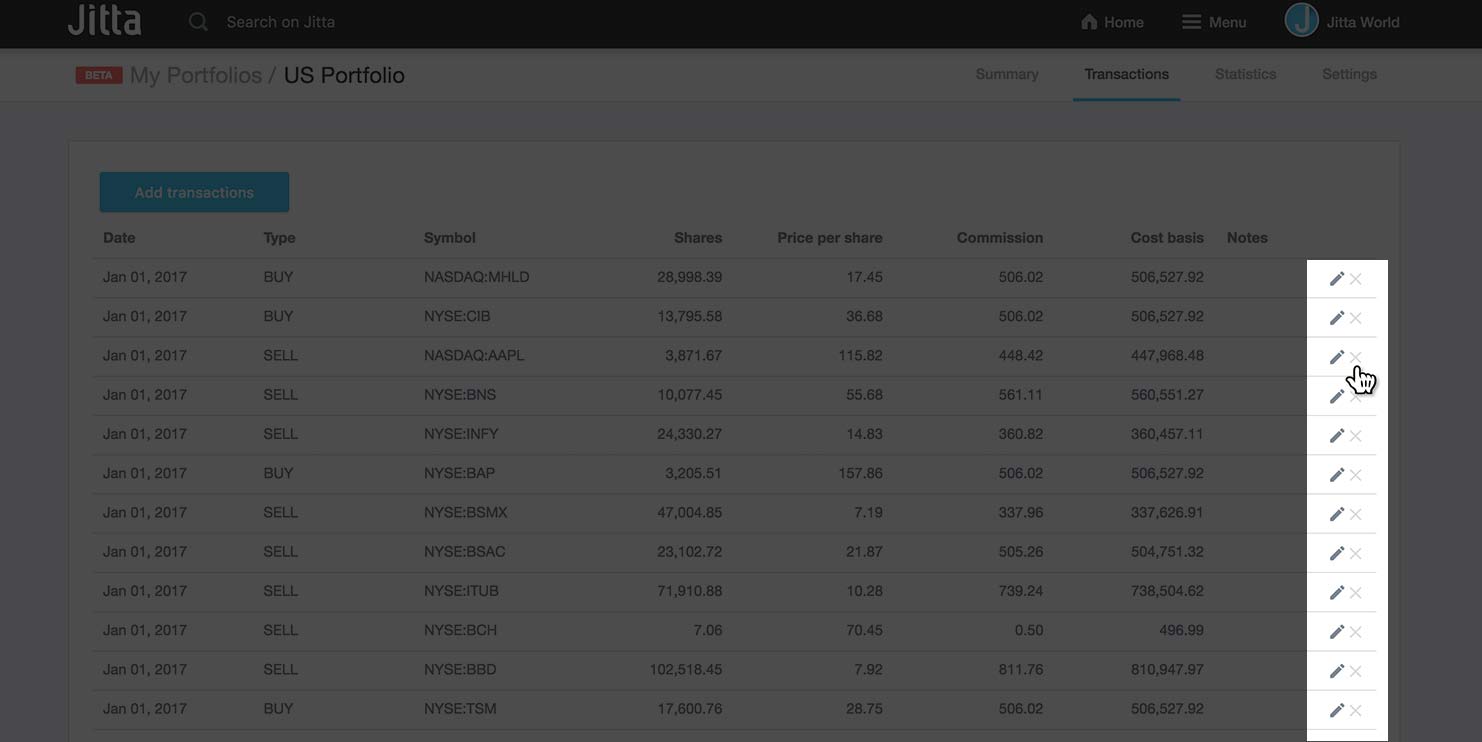

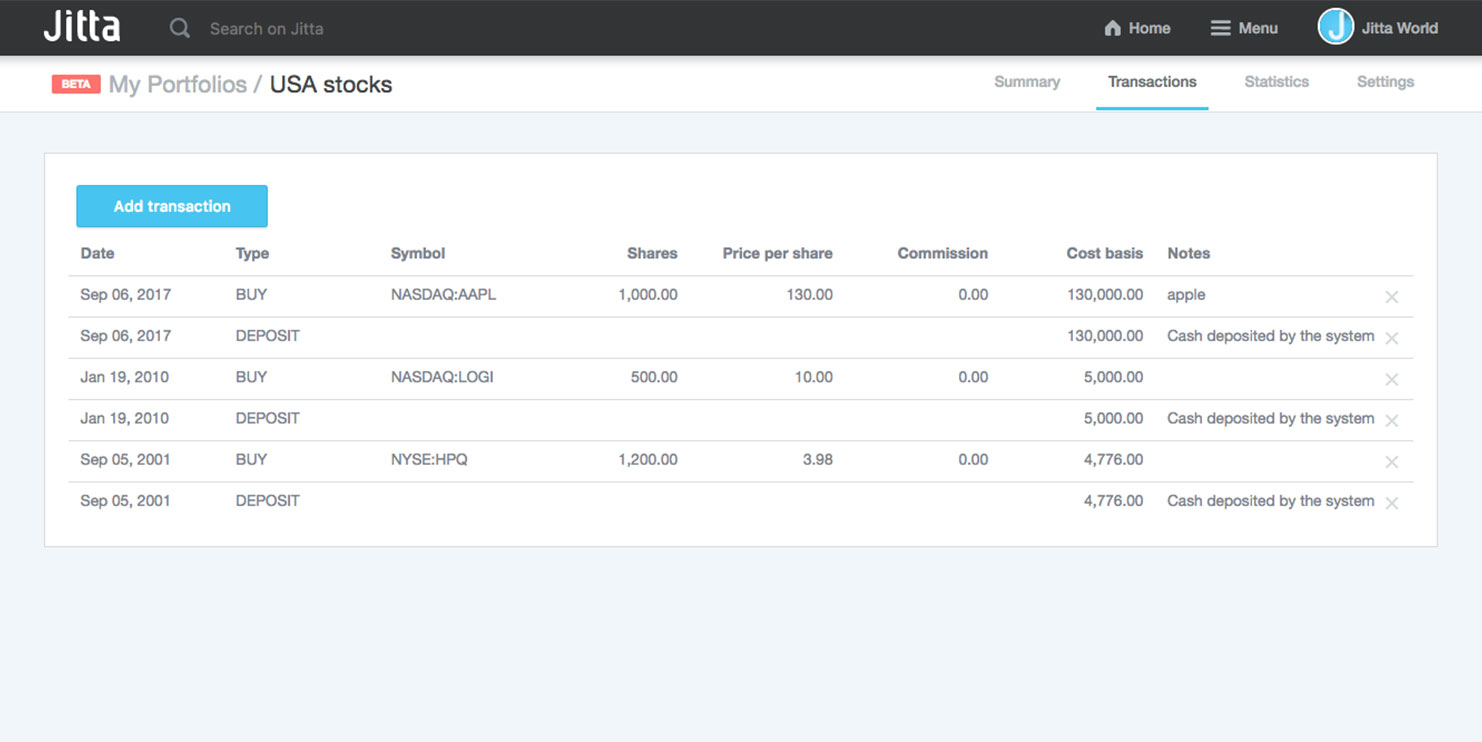

To delete a transaction, click X.

Click SAVE TRANSACTIONS when you are done. If you don’t want to save, click DISCARD.

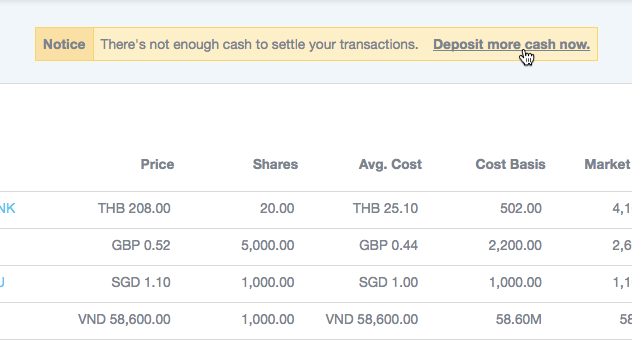

If you see this notification NOTICE: THERE’S NOT ENOUGH CASH TO SETTLE YOUR TRANSACTIONS. DEPOSIT MORE CASH NOW, it means you didn’t deposit enough cash to cover all your transactions. Just click DEPOSIT MORE CASH NOW and the system will automatically add the missing cash for you.

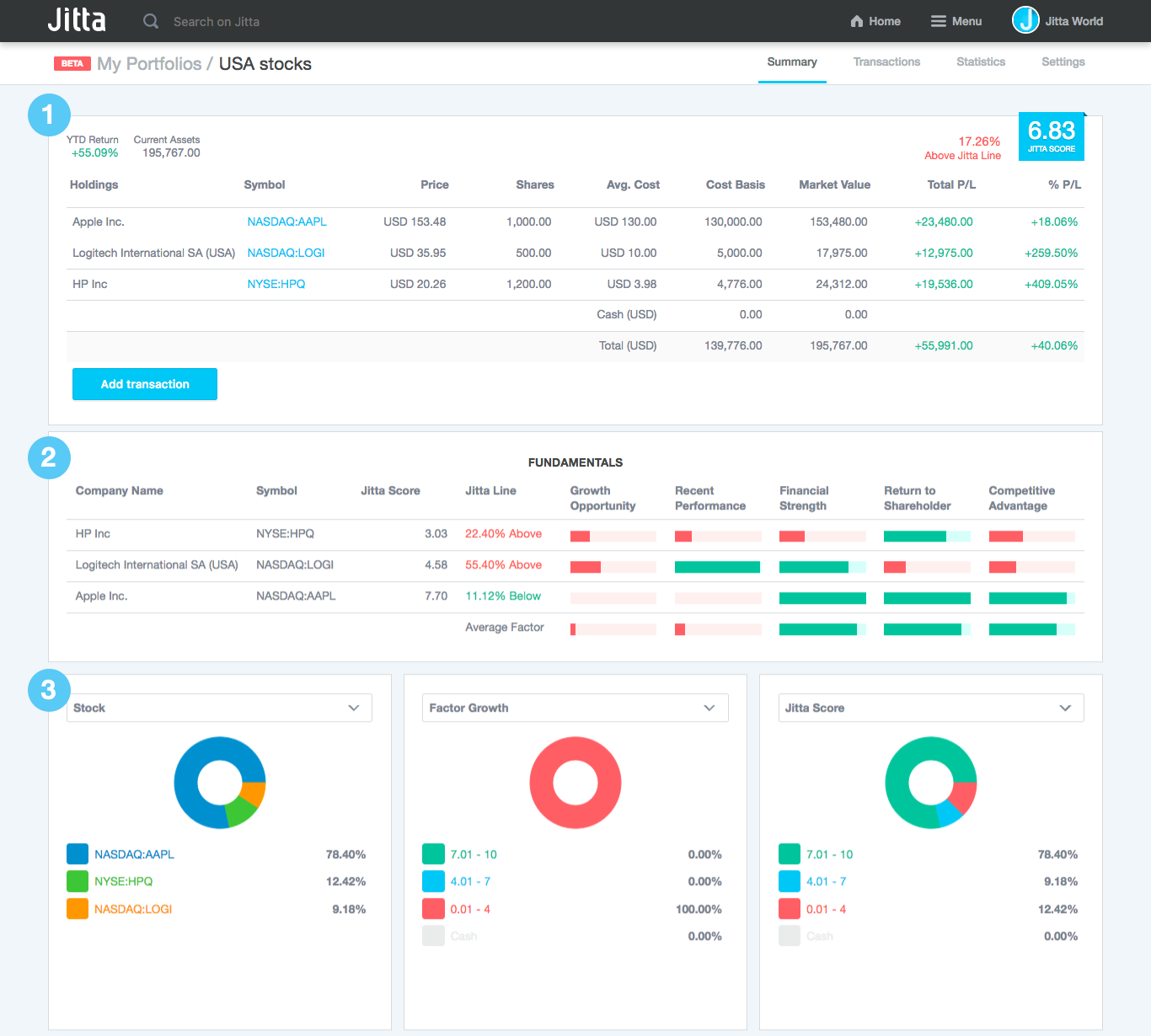

When you’re done adding the transactions, you can assess the health of your portfolio using graphs, charts and statistics provided, which include

- Portfolio returns

- The quality of each stock you own, as measured by Jitta Factors

- Asset allocation by stock name, Jitta Factors, Jitta Score and Jitta Line

In case you want to edit the transactions, click the TRANSACTIONS tab at the top. You can add more transactions by clicking ADD TRANSACTIONS or delete by clicking X.

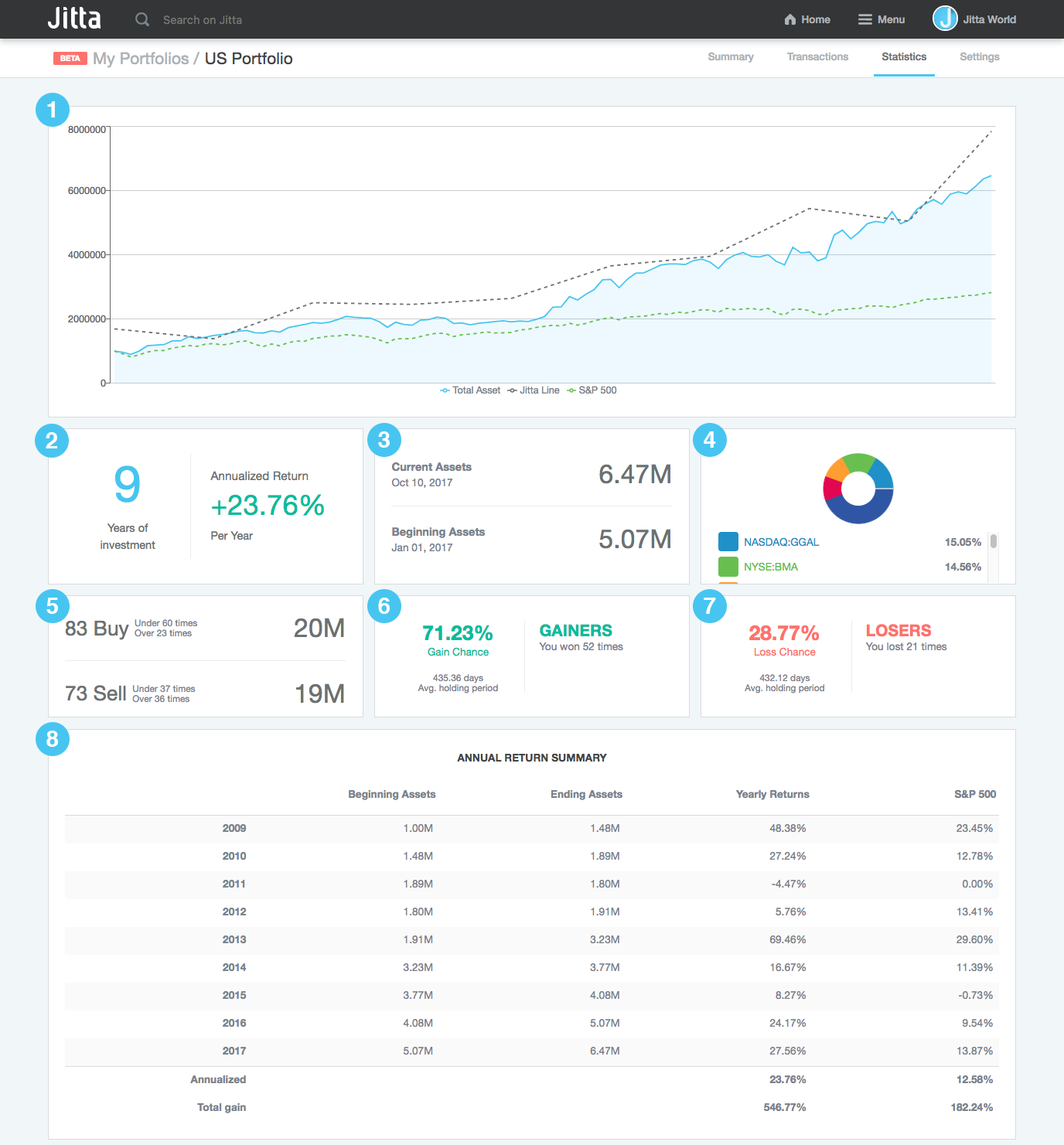

To view detailed performance of your portfolio, click the STATISTICS tab. You’ll see everything from annual returns to year-to-date returns that can help you fine-tune your investment strategy.

- This graph shows your returns compared to the market index and your portfolio’s fair value (Jitta Line).

- Your average annualized return

- The value of your assets at the beginning compared to now

- The weight of each stock you hold

- Stats on how many times you buy above/below Jitta Line

- How many times you’ve profited from selling stocks

- How many times you’ve lost money selling stocks

- Annual rates of return

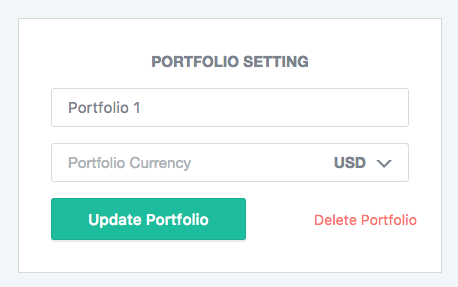

If you want to change the name or the currency of a portfolio, click the SETTINGS tab. Rename or change the currency and click UPDATE PORTFOLIO.

Track and assess your portfolio performance frequently on Jitta Portfolio. You’ll be able to improve your investment strategy and achieve optimal returns in no time.