the first things we need to understand are

“What is stock?” and “What causes stock prices to rise and fall?”

If we understand them, “investing is no longer difficult”.

What is stock?

Stock in the stock market is a share in the ownership of a company. It’s no different from being a partner in a company we invest in with our friends. For example, Company A has a total of 1,000,000 shares. If we hold 10,000 of Company A shares, it means we have a 1% partnership stake in this company.

And it also means we are entitled to 1% of the rights to Company A such as the right to assets, the right to dividend, or the right to vote on certain matters.

If Company A is listed, we can trade those 10,000 stocks we own in the stock market. The proportion of the stocks or rights we have in Company A will increase or decrease by the number of stocks we have traded.

Therefore, behind the stock symbols we see in the stock market such as GOOG , CMG, ROST are companies that operate real business.

Those companies are managed by real individuals, earn their income and profits, and own their assets just like the businesses we see daily. For example:

- GOOG is Google Inc which dominates the market share of search engine worldwide.

- CMG is Chipotle Mexican Grill Inc which owns thousands of Mexican restaurant throughout United States.

- ROST is Ross Stores Inc which operates thousands of the off price department stores nationwide.

We can buy these companies’ stocks and acquire a partnership stake in each company through our investment in the stock market.

What causes stock prices to rise and fall?

the stock traded in the stock market

is a partnership

stake in each company,

it’s easy to understand that

“Stock prices will rise and fall based on a company’s business performance or profit each year”.

It’s no different from when we invest in a new business with our friends.

it can pay more dividend,

and its stock value will keep rising because people will want to buy its stocks from us.

no one will want to be a partner,

and the value of the stocks we hold will keep falling.

If the company finally goes broke and shut down, our stock value will become zero.

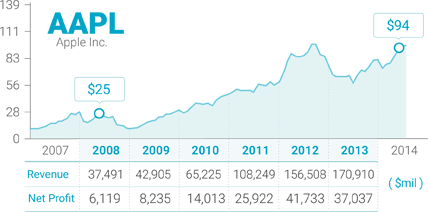

Let’s look at a simple example of BBRY vs AAPL.

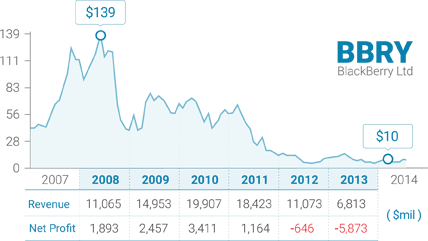

BBRY, the provider of Blackberry phones popular in worldwide many years ago,

and AAPL, or Apple Inc., which offers iPhone.

Looking at company performances, we can see that BBRY’s sales and profit kept declining every year; from huge profits to billions of loss in 2013. As a result, BBRY stock price fell from $139 to merely $10.

Meanwhile, we can see that AAPL sales and profit kept growing; from $6,119 million profit/year to $37,037 million in 2013. And that’s why AAPL”s stock price rose from $25 to $94.

So we can see that when a company’s profit keeps rising, its stock price will keep rising too. And when a company keeps selling less products and making less profit, its stock price will keep falling as well.

stock represents a stake in an operating business

and its price depends on how much profit a company makes each year.

“Which investment principle will help us profit from the stock market?”

has emphasized the easiest investment principle as

“Buy a wonderful company at a fair price”

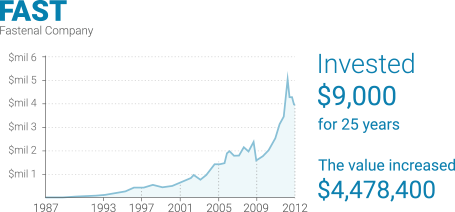

The above example is an investment in Fastenal Company which operates construction supply business in the U.S. Over 25 years, the company grew from hundreds to 2,600 branches. And clearly, the more branches, the more Fastenal income and profits grew each year.

If we had invested in Fastenal (FAST) stocks back in 1987 at $9,000 and simply held on to them during the company’s consistent growth, after 25 years, our $9,000 investment would have increased to $4,478,400 or turned a profit of 49,660% (calculated as 28.2% compounded interest per year). That is a massive profit.

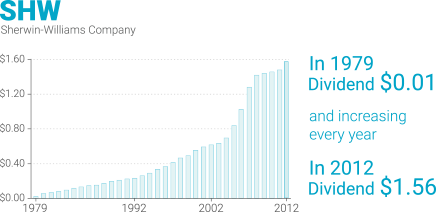

Or in the case of Sherwin Williams, this wonderful company which sells various paint and coating products made consistently growing profits and paid higher dividends every year. We need only to buy its stocks at a fair price and hold on to them; the dividends paid out in just a few years would exceed the invested principal. And the wonderful thing is, after we had fully received the invested principle, we would still keep getting the dividends for the rest of our life. Also, the stock price would certainly be bound to rise many folds.

It’s no different from owning a great property to let out. We could raise the rent every year and earn higher income every year while the property value would also keep increasing every year.

sound easy. Just find out which companies are great, buy their stocks, and enjoy the profits.

many people are unable to invest the Buffett’s way.

Because once we start to invest,

it’s not as easy as we expected. The reason is

“everyone will encounter these 3 main problems”.

Don’t

knowwhich companies

are wonderful.

In the investment world, we need the knowledge in finance and the ability to read financial statements in order to determine which companies are wonderful. A company’s financial statements typically include an income statement, a balance sheet and a cash-flow statement.

Most people are unable to understand the business through financial statements, and therefore unable to decide which particular stocks among many in the stock market represent wonderful companies.

Don’t

knowthe fair

price.

Even though we can identify the great companies, but if we can’t determine their business value, we might pay too much for their stocks and stand a chance of losing money.

To determine a company’s fair value, we need to understand its financial statements. We also need an understanding of various businesses as well as a valuation skill, which takes a long time to acquire and tends to be difficult for people outside of financial industry.

Don’t

knowwhether the business gets better

or worse over each passing year

The last problem is the time needed to follow every quarterly financial statement updates. As business changes all the time, even a wonderful company can falter when new competitors show up. Take Blackberry for example; the former top smartphone provider in the world can now hardly sell its products. Therefore, besides the financial statement analysis and business valuation skills, investors must spend a considerable amount of time keeping track of the performance of every company they invest in. That’s why people who don’t have that much time are unable to follow this principle.

so that investors can use Warren Buffett’s investment approach easier

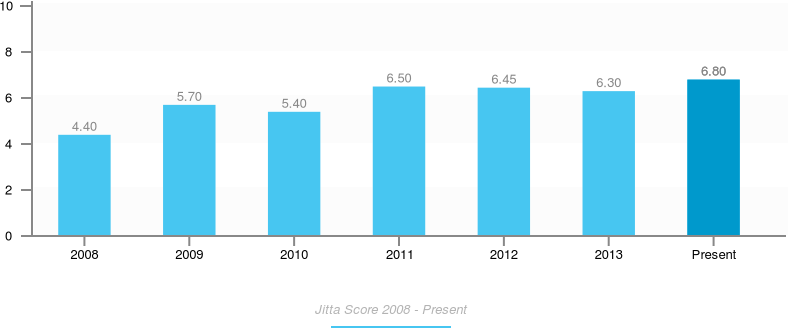

and get higher returns. Jitta will perform a retrospective analysis of

every company’s financial statementsand summarize them into:

a fair price” principle in no time.

Simply “select the stocks with high Jitta Score whose prices are lower than Jitta Line”.

Jitta Line rise, you can keep its stocks. But if the company ever falters and its Jitta Score and Jitta Line start to fall,

that’s the sign for you to sell.